2014

Why buy off the plan?

Charly Tannous / 0 Comments /Clients often ask “what do they mean by buying a property off the plan?”

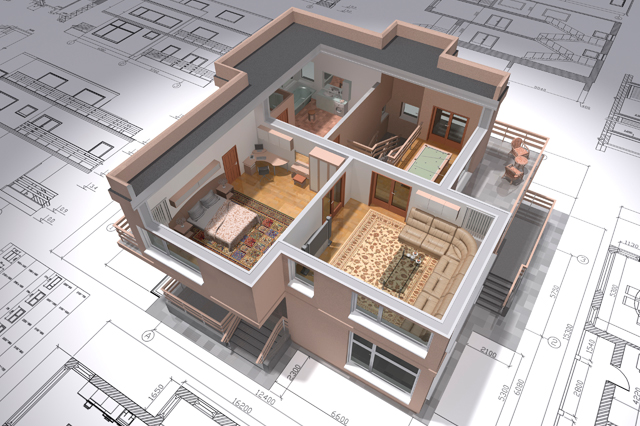

Buying off the plan is essentially purchasing property that does not exist at the time the contract is signed as it is yet to be constructed or still in its early days of construction. Generally people want to touch, feel and see what they are buying before the buy it. However, an off the plan purchase is exactly what the term means, you are buying a property by reference to a draft strata plan. Buyers usually get an idea of what the finished product may look like by viewing marketing floor plans and artist impressions of what the property will end up looking like.

What are the benefits of buying off the plan ?

There are numerous perceived benefits associated with off the plan purchasers, some of which are as follows:

Tax benefits

Buying off the plan offers some tax benefits as you know that the property is a brand new property when you settle on the purchase. The tax benefits arise as a buyer can realise significant depreciation tax savings that are greater than those available on existing buildings if purchased for investment purposes. Depreciation expenses that may be claimed include the building finishes, furniture and fittings.

However a buyer should always seek advice from a financial adviser or accountant before considering an off the plan purchase for investment purposes.

Discounted Purchase Price

Generally before constructions starts, developers are keen to sell as many units as possible, so getting in early generally allows a buyer to purchase the unit at a discounted price compared to when the construction is nearing completion.

Furthermore by the time construction has been completed, which is generally a few years after you sign the contract, the property will most likely have increased in value as a result of the passage of time.

Time to save for deposit

Off the plan purchases are a great way to buy if you do not currently have the funds or the means to purchase the property at the contract date as it allows you time to get the finance or save up for the purchase price.

Choice of finishes and fittings

Buying off the plan also gives the purchaser the choice to co-ordinate with the builder and choose their own fittings and finishings. This may come at an extra charge depending on the contract, however, it does give a purchaser more autonomy than buying an existing building.

Risks associated with buying off the plan?

Cancellation by the vendor

Developers take risks when selling off the plan. More often than not the plan is not registered and the sales contracts are all pending registration of the plan, because without the registration the property does not actually exist.

Developer goes into liquidation

Unfortunately people may be looking forward to moving into their new home and then they find out the developer has gone bust. This is a big underlying risk in purchasing off the plan. Buyers should always seek to secure their interest in an off the plan purchase by consulting a solicitor.

The dimensions may change

Developers generally include a provision in the sales contract that the dimensions on the draft plans may actually change. They also provide that unless it is a significant change a buyer would not be able to rescind.

You may not like it when it’s finished

Generally when purchasing off the plan it is hard to imagine what the finished product is going to look like. This may cause the buyer to have high expectations of what the property will look like and sometimes the finished product does not meet the buyers expectations.

Buying off the plan for first home buyer’s

Buying off the plan currently is great for first home owners in NSW. The benefits are first home owners get a grant of $15,000 (which will change to $10,000 1 January 2016). Also if the price of the property does not exceed $550,000 they are exempt from paying stamp duty. So with all the above savings it also gives first home owners the chance to save up the funds to pay for the property, because completion generally takes a few years.

Sage Solicitors

If you are considering the purchase of an off the plan property, please feel free to contact Charly Tannous or Adam Majdoub at Sage Solicitors on the 02 9713 7544 for helpful advice and legal assistance in reviewing the Contracts and undertaking the conveyancing work for you.